If you find yourself making the same old, same old New Year’s Resolutions every year, we wanted to help change things up by offering you some new ideas you might want to add to your list of goals for 2017.

- Schedule checkups. Schedule your yearly physical and your two dentist visits at the beginning of the year. Your health is your most valuable and irreplaceable attribute—make it a priority.

- Learn something new. Whether it’s learning how to play the piano, learning another language or reading about your favorite historical figure, put aside some time to learn something new this year.

- Monitor your credit. Vow to check your credit score regularly to guard against fraud. Credit cards with free FICO scores include: Discover, Chase, Bank of America, Barclaycard, Commerce Bank, American Express, First Bankcard, and the Walmart credit card. You can get a free credit check once a year from www.annualcreditreport.com.

- Say “no” more. Let’s face it, we’re all busy. If there are things on your schedule that don’t edify you in any way, consider saying no to the next invitation. If that committee never really gets anything done or your friends just want to sit around and complain, give yourself permission to say “no” and do something else with that time.

- Pay off a debt. If you still owe money on something, commit to paying an extra amount every month toward principal; for instance, an extra $100 a month on your credit card, car or house payment. Even a small amount can make a big difference in the long run.

- Sell stuff. If you have items in your home that are valuable but simply taking up space because you don’t use them, consider selling them, or donate them to a charity as a tax write-off. Some ideas: that fancy china pattern you really don’t like anymore, a piece of artwork not to your current taste, or the fitness machine you’ve never used. You’ll feel better without the clutter.

- Make a budget. Take a look at what you spent last year on everything, and create a new budget that includes your priorities. Think outside the box. For instance, you might be spending money on groceries that go bad because you actually hate to cook. Maybe you’d save money by eating out when restaurants offer discounts.

- Keep a journal. Even if you’re “not a writer” you can benefit from keeping notes to yourself on a daily, weekly or monthly basis—perhaps even as a way to hold yourself accountable. If you date each entry, you’ll have a written timeline you can refer to when creating next year’s resolutions. If you consider yourself creative, a journal is imperative to explore your most profound ideas.

- Eat healthier. If the goal of “losing weight” is a losing proposition (because that one has been on your resolution list for years!), decide instead to replace a few meals with something healthier. For instance, have a salad night once per week which includes all your favorite vegetable toppings. Or commit to purchasing and eating seasonal local fruit every month (apples in fall, strawberries in spring, cantaloupe in summer, etc.)

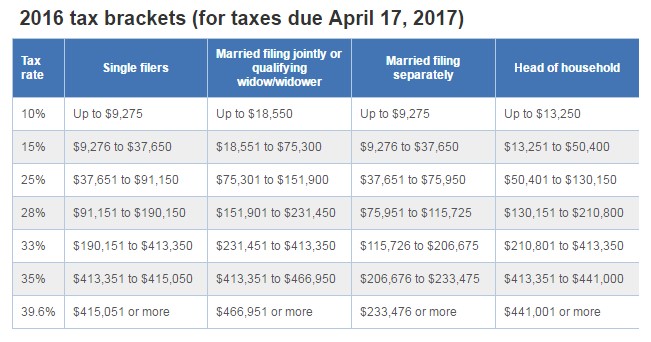

- Earn more. Whether it’s asking for a raise at work, taking a side job or starting a new business, find a way to earn more money this year. Keep in mind that tax brackets matter, and if you are required to take an RMD (Required Minimum Distribution) from a qualified plan, this adds to your income for the tax year.

New tax brackets for 2017 (taxes due April 15, 2018) here.

- Move more. Along the same lines as #9, if you hate to exercise, find something that you do enjoy. You could take up salsa dancing, or just dance around the living room. Or create a family game by having everyone do 10 jumping jacks each time there’s a commercial on TV.

- Categorize savings. If you’re like most people, you probably have short- and long-term goals. Put a monthly dollar amount aside for each objective—vacation, new car, house down payment, wedding, retirement.

- Categorize spending. If you have a budget, this should be easy. Here are some suggested categories: monthly fixed expenses (housing, utilities, auto), variable expenses (hair/grooming, gifts, clothing, entertainment), yearly expenses (accountant, insurance premiums, tag/license renewals.)

- Max out your retirement savings. In today’s economy, it’s imperative to take care of yourself and your personal future. If your employer offers a plan like a 401(k), consider contributing as much as possible. If not, consider contributing the maximum amount to your own IRA or other retirement investment.

- Build an emergency fund. Most experts now recommend that you keep an emergency fund on hand equal to at least six months (or more!) of your monthly income.

- Have more fun. Make it a point to watch a comedy once a week, go to the park, tickle your children until they giggle, or play fetch with the dog every weekend. Whatever it is that makes you smile, do it more.

- Meet with your financial advisor regularly. Not only can Wood Financial Group help you review your overall financial plan and make sure it’s on track to meet your goals, but we will also review all of your accounts and make sure that your loved ones are all properly included as your family grows and changes through the years. Why is this important? Because your beneficiary designations actually take precedence over your will.

Contact Wood Financial Group in Brentwood, Tennessee or call us at (615) 221-0927. We look forward to working with you in 2017!